aTyr Pharma NASDAQ ($ATYR): One Drug, One Shot, One Shelf Too Many

Reports

•

September 9, 2025

aTyr Pharma NASDAQ ($ATYR): One Drug, One Shot, One Shelf Too Many

Reports

•

September 9, 2025

Twenty years, zero products, and now one noisy trial stands between shareholders and a 60–80% collapse.

A Platform in Search of an Indication

When aTyr Pharma (NASDAQ: ATYR) went public, it sold investors on a dream: a breakthrough “platform” based on the mysterious biology of tRNA synthetases. The pitch was that this unique corner of cell machinery could be tapped to generate a pipeline of first-in-class drugs across multiple diseases.

Fast-forward almost twenty years. The platform is still a platform in name only. The muscular dystrophy program? Shelved. The immuno-oncology effort? Dead after weak preclinical data and a round of layoffs. The “pipeline” has shrunk down to a single lifeline: efzofitimod, a biologic pitched as a solution for pulmonary sarcoidosis.

That’s the uncomfortable truth: ATYR is no longer a platform company. It is a one-drug company. If efzofitimod fails, there’s nothing left. If it wins, the company will immediately turn to Wall Street to monetize the victory through dilution.

And this is where investors need to focus.

The data aren’t decisive. Phase 2 showed modest improvements at best — statistically significant only in post-hoc PROs at the highest dose. Lung function results weren’t significant.

The Phase 3 design is stacked with noise. The endpoint is steroid reduction after a year of forced tapering — a measure known to fluctuate in sarcoidosis even under placebo.

Management already filed its escape hatch. In August 2025, weeks before topline results, aTyr filed a fresh Form S-3 shelf registration, effective Aug 18. The ATM window is open, and dilution is coming.

This isn’t just another risky biotech. It’s a textbook example of how small-cap biotechs game the system: sell the platform story, pivot after failures, and keep Wall Street on the hook until the very last card is played.

If you own ATYR, you own the outcome of a single trial — EFZO-FIT — with a steroid-sparing endpoint that is extremely difficult to win unless the drug’s effect size is robust and undeniable.

Platform Autopsy: Two Decades, Zero Deliverables

aTyr Pharma didn’t start as a sarcoidosis company. It started as a tRNA synthetase “platform” play — a story pitched to investors as a discovery engine with limitless applications. The reality is less glamorous: twenty years in, the “platform” has yet to yield a single commercial product. What it has produced instead are quiet failures, abrupt layoffs, and desperate pivots.

Resolaris (ATYR1940): The Muscle Drug That Never Flexed

Launched: Mid-2010s as the company’s flagship in rare muscular dystrophies (FSHD, LGMD).

The pitch: Modulate immune pathways, reduce muscle inflammation, slow progression.

The outcome: Early trials showed “promising signals” but failed to generate durable, convincing efficacy. Patients didn’t meaningfully improve, regulators weren’t impressed, and enthusiasm faded.

Status: Quietly shelved by 2017–2018. No big press release announcing failure, just a slow disappearance from investor decks.

Figure: aTyr’s Early “Encouraging Signals” for Resolaris (2016)

In March 2016, aTyr Pharma issued a press release touting “potential activity signals” from a small Phase 1b/2 trial of Resolaris in rare muscle diseases. Despite the optimistic tone — highlighting safety, tolerability, and the potential for expansion into multiple indications — the program never delivered durable efficacy. By 2017–2018, Resolaris was quietly shelved, disappearing from investor decks without a formal announcement. This marked the first of aTyr’s flagship failures, foreshadowing its pattern of hype, pivot, and silence. READ HERE

Takeaway: The first big promise out of the tRNA platform evaporated without delivering a viable path forward.

ORCA: The Immuno-Oncology Bet That Imploded

Launched: 2017 as an ambitious pivot into cancer immunotherapy.

The pitch: Apply the same extracellular tRNA biology to “resokines” and immune modulation in oncology.

The outcome: By early 2018, preclinical data failed to show compelling activity. The program was stopped cold.

Fallout: aTyr announced 30% layoffs in May 2018, blaming the poor ORCA data and acknowledging resources had to be retrenched around their last surviving hope, efzofitimod.

Status: Abandoned. Another “transformational” pillar reduced to dust.

Figure: ORCA Implodes, Layoffs Follow (2018)

In May 2018, aTyr Pharma announced it was cutting 30% of its workforce after its ORCA immuno-oncology program collapsed in preclinical testing. The company admitted its anticancer antibodies “lacked the required efficacy,” forcing it to halt IND-enabling activities. ORCA had been pitched as the company’s next transformational pillar, leveraging the “resokine pathway” to enhance checkpoint inhibitors. Within a year, the program was gone, and efzofitimod became the company’s last remaining shot. READ HERE

Takeaway: The second major platform bet collapsed before ever reaching the clinic, leaving the company gutted and on life support.

The Pattern: Pivots, Not Progress

2005–2015: Platform hype.

2015–2017: Resolaris hype cycle → shelved.

2017–2018: ORCA hype cycle → terminated, layoffs.

2018–Present: Efzofitimod hype cycle → now the only card left in the deck.

This isn’t the track record of a thriving platform company. It’s the track record of a biotech burning through narratives until only one story remains.

Blunt Conclusion: aTyr’s history doesn’t convict efzofitimod by itself, but it sets a precedent investors can’t ignore: every prior “breakthrough” ended in silence. The burden of proof for this Phase 3 is sky-high.

The Drug, The Data, The Odds

3.1 Mechanism & Preclinical: Biology vs. Reality

Target: Efzofitimod (ATYR1923) binds Neuropilin-2 (NRP2), a receptor expressed on T-cells, macrophages, and granulomas — the immune clumps that define sarcoidosis.

Claim: By modulating NRP2 signaling, efzofitimod dampens inflammation without broad immunosuppression, offering a “precision steroid alternative.”

Evidence: In animal and in-vitro models, efzofitimod reduced certain inflammatory markers and cytokines.

But:

Preclinical models did not demonstrate a significant reduction in granulomas, the hallmark lesion of sarcoidosis.

These were reductionist systems (P. acnes mouse; in-vitro granuloma cultures) — useful for plausibility, but historically unreliable for predicting human outcomes.

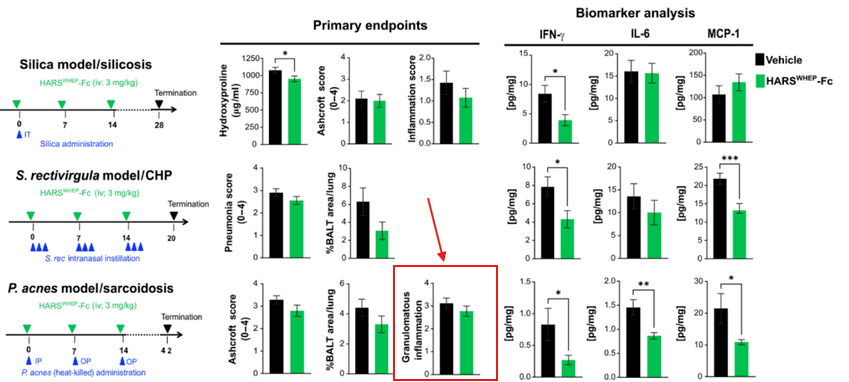

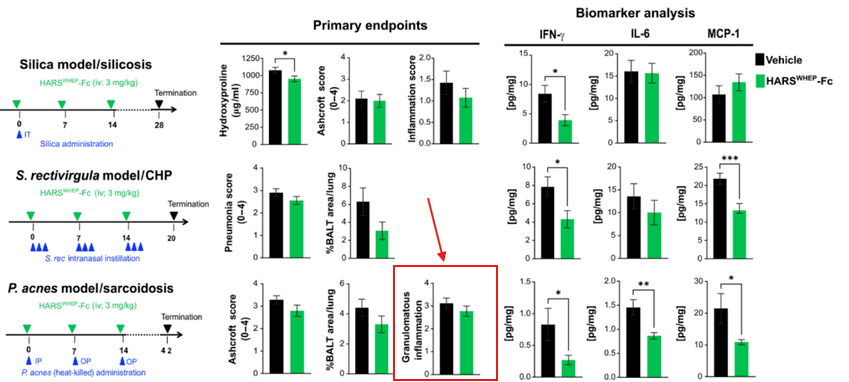

Figure: Preclinical Disconnect in Sarcoidosis Model

In the P. acnes-induced sarcoidosis mouse model (bottom row), efzofitimod reduced certain biomarkers (IFN-γ, IL-6, MCP-1) but showed no significant impact on granulomatous inflammation (far right panel). This gap highlights the translational weakness: efzofitimod may modulate inflammatory signals, but it fails to reduce the hallmark lesion of sarcoidosis — granulomas.

Blunt read: There’s enough biology here to justify running a trial. But there’s not enough to call efzofitimod a validated drug candidate.

3.2 Phase 1b/2a (Chest, 2023): What Really Happened

Design:

37 patients with pulmonary sarcoidosis.

Placebo vs. efzofitimod (1, 3, 5 mg/kg).

Primary endpoint: Safety, not efficacy.

All patients underwent a forced steroid taper toward ≤5 mg/day.

Results:

Safety: Clean — no dose-limiting toxicities.

Steroid reduction:

~22% baseline-adjusted relative reduction vs. placebo at 5 mg/kg.

Absolute difference modest; variability high.

Patient-reported outcomes (PROs):

Several statistically significant wins in fatigue and lung symptom domains — but only in the highest dose group.

Lung function (FVC % predicted):

Trend in right direction at higher doses.

Not statistically significant.

Follow-up analyses:

Exposure–response modeling (Frontiers Pharmacol, 2023): Suggested patients with higher efzofitimod exposure had greater steroid reduction and FVC improvement. But this was post-hoc modeling, not pre-specified.

ERS Open Research (2025): Confirmed dose-response signal and PRO significance at higher doses. Still no slam dunk on hard lung function endpoints.

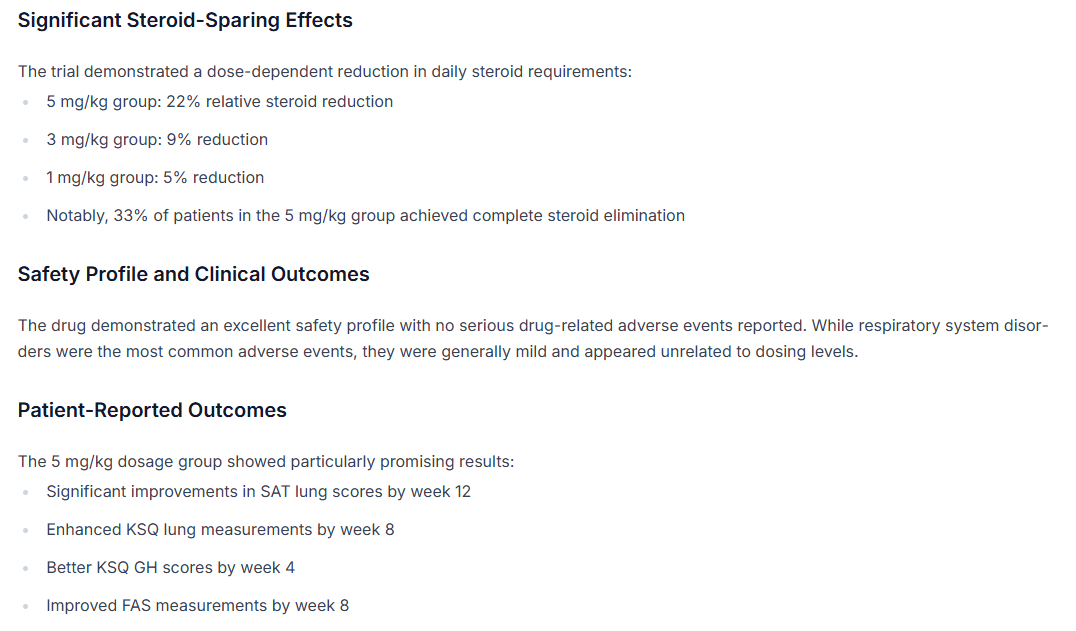

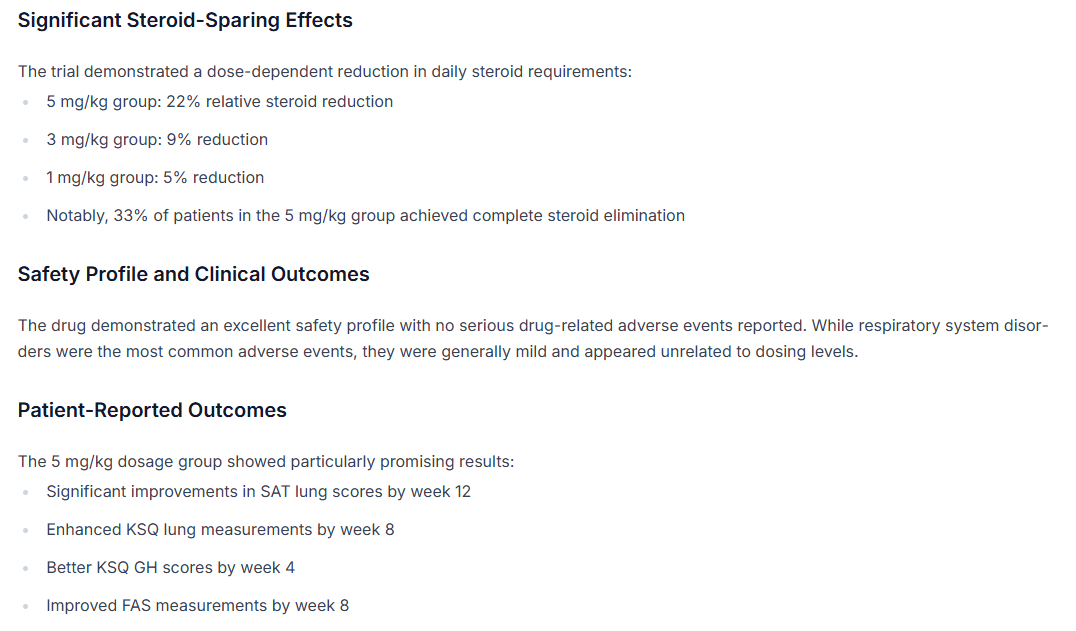

Figure: Phase 2 Trial Outcomes for Efzofitimod (Trial.MedPath, 2025)

Steroid-sparing: 22% relative reduction at 5 mg/kg; smaller reductions at 3 mg/kg (9%) and 1 mg/kg (5%).

Safety: Clean, with no serious drug-related adverse events.

Patient-reported outcomes (PROs): Significant wins at the highest dose (5 mg/kg) across fatigue, lung scores (SAT, KSQ), and quality-of-life domains.

Interpretation: Even in polished media coverage, the picture is clear — activity, not proof. Efficacy relied on PROs and steroid tapering at the highest dose, while lung function (FVC) failed to reach statistical significance. READ HERE

Blunt read: The Phase 2 data showed activity, not proof. Stat-sig patient questionnaires are nice, but regulators and investors don’t approve drugs on surveys alone. Lung function and steroid endpoints didn’t clear the bar.

3.3 Phase 3 EFZO-FIT: A High-Wire Act

Design:

268 patients, global, 52 weeks.

Efzofitimod 3 mg/kg and 5 mg/kg vs placebo.

Primary endpoint: Change in steroid dose at Week 48 under a forced taper.

Secondaries: Patient-reported outcomes, lung function, symptoms.

Risks in design:

Spontaneous improvement: Sarcoidosis often improves over 12 months even without drug — placebo patients naturally taper steroids.

Taper variability: Different patients tolerate steroid reductions differently, creating noise.

Small true effect size: If efzofitimod’s benefit is modest, it risks being buried under placebo-driven taper success.

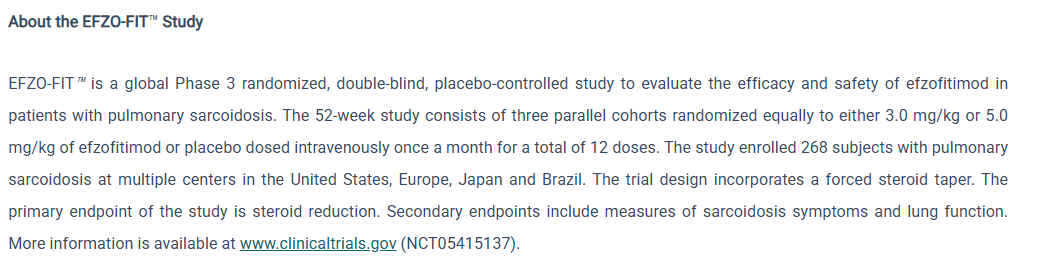

Figure: EFZO-FIT Phase 3 Trial Design (Company Materials)

The EFZO-FIT trial enrolled 268 patients with pulmonary sarcoidosis across the U.S., Europe, Japan, and Brazil. It is a 52-week, double-blind, placebo-controlled study testing 3.0 mg/kg and 5.0 mg/kg of efzofitimod vs. placebo, dosed monthly for 12 months. The design incorporates a forced steroid taper, with the primary endpoint set as steroid reduction. Secondary endpoints include sarcoidosis symptoms and lung function.

Interpretation: The company’s own description confirms the inherent trial risk: forced steroid taper as a primary endpoint is notoriously noisy, especially in a disease like sarcoidosis that can improve spontaneously. Unless efzofitimod shows a large, undeniable effect, small deltas risk being buried in placebo-driven improvement. READ HERE

Blunt read: Unless efzofitimod delivers a large, clear effect, this trial is set up to produce ambiguous or negative results. Small deltas will not survive statistical rigor.

3.4 Our View

Preclinical: Mechanism plausible, but weak translational foundation.

Phase 2: Showed signals of activity, but failed its primary efficacy test.

Phase 3: A risky design in a noisy disease — low-to-moderate probability of a decisive win.

Bottom line: Efzofitimod has biology. It has signals. What it doesn’t have is proof. And Wall Street is pricing it as if proof is a given.

Mechanistic Red Flags: The Biology Doesn’t Hold Up

Binding to NRP2 is Unproven

aTyr’s entire pitch hangs on efzofitimod binding to Neuropilin-2 (NRP2) as its precision mechanism. But there’s a glaring hole: there are no published affinity values (Kd) showing how tightly efzofitimod actually binds. In drug development, binding affinity is table stakes — it tells you if the molecule has a strong and specific interaction with its target. Without it, the “precision” claim is smoke.

The assays they’ve shared lean on avidity-driven events — basically multivalent interactions that look like binding, but aren’t the same as high-affinity lock-and-key proof. This is biotech 101: if you can’t show affinity, you don’t have a target.

No Downstream Signaling Shown

Even if efzofitimod touches NRP2, the real question is: does it do anything useful once it’s there? aTyr hasn’t shown it. There’s no evidence of downstream signaling — no phosphorylation events, no p-AKT activation, no angiogenesis signal.

Instead, they offer a dimerization assay: showing NRP2 cozying up to Plexin or FLT4. That’s proximity, not proof. Without a signaling cascade, the mechanism is a car with no engine. It looks like a vehicle, but it isn’t going anywhere.

Speculative Alternate Mechanisms

Independent analysts have speculated efzofitimod could be triggering CCR5 chemotaxis, potentially leading to lymphangiogenesis and an immunosuppressive phenotype in vivo. But this is pure conjecture. There are no wet-lab experiments validating this alternate pathway.

In other words, we’ve left the realm of evidence and entered the realm of fan fiction. A “maybe it does this” explanation is not how you de-risk a $500M biotech.

NRP2 is a Graveyard Pathway

aTyr isn’t the first to chase NRP2 as a therapeutic lever. Others have tried — and failed. The pathway has proven intractable in multiple settings. Sarcoid experts themselves are skeptical that NRP2 can serve as a “master switch” to resolve granulomatous inflammation. If history is any guide, this isn’t a revolutionary precision target — it’s a cul-de-sac where programs go to die.

Poor Preclinical Translation

Ask any sarcoid researcher which preclinical model best mirrors the disease, and most will point to the P. acnes mouse model. Even there, efzofitimod showed no meaningful reduction in granuloma burden. Yes, it shifted some inflammatory markers, but the core pathology — the mud balls that choke off lungs — didn’t budge.

That’s a death knell for translation. If your drug doesn’t clear lesions in the model most respected by the field, it’s fantasy to expect a slam dunk in humans.

Why This Matters: This isn’t nitpicking. Drug development lives and dies on mechanism. Efzofitimod’s mechanistic case is riddled with gaps: no binding data, no signaling proof, speculative alternate MoAs, a target pathway littered with prior failures, and preclinical models that don’t translate.

Blunt Read: Efzofitimod has biology, but not proof. It’s a story stitched together with hand-waving and wishful thinking. When independent analysts outside BMF flag the same blind spots, the conclusion is unavoidable: Phase 3 is less a test of science than a test of investor gullibility.

Follow the Money: The Shelf, the ATM, and the Inevitable Dilution

The Playbook

In small-cap biotech, the science is only half the story. The other half is how management funds survival. aTyr is following the script to the letter: raise opportunistically, file a shelf before a catalyst, and prepare to dilute regardless of outcome.

The Shelf

Filed: August 7, 2025.

Declared Effective: August 18, 2025.

Form: S-3 shelf registration.

What does this mean? With the stroke of a pen, management gave itself the ability to issue new securities at will — stock, warrants, debt — without waiting months for SEC review. Filing just weeks before a binary catalyst is no coincidence. It’s insurance.

If data are positive: They can sell into the pop immediately, capturing inflated valuations before reality sets in.

If data are negative: They can still raise survival capital without delay.

Figure: $300 Million Shelf Registration (Filed August 7, 2025)

In August 2025, just weeks before the pivotal EFZO-FIT readout, aTyr Pharma filed an S-3 shelf registration authorizing the sale of up to $300 million in securities — including common stock, preferred stock, debt, and warrants. This filing, effective August 18, gave management the ability to issue shares instantly without waiting for SEC clearance. The timing is no accident: it’s pre-catalyst insurance, ensuring dilution whether data are good or bad. READ HERE

Blunt translation: Filing the shelf before the readout is management saying out loud: “We’re going to dilute you, one way or another.”

The ATM

Q2 2025 raise: aTyr tapped its at-the-market (ATM) facility, raising ~$30.7M through Jefferies.

Cash position: $83.2M on June 30, 2025 → $114M pro forma after the raise.

Burn rate: ~$20M/quarter (R&D + G&A).

Figure: ATM Dilution and Cash Runway (Q2 2025 10-Q)

From aTyr’s Q2 2025 10-Q: the company disclosed raising $36.7M via its at-the-market (ATM) program with Jefferies, selling 8.77 million shares at a weighted average price of $4.32. As of June 30, 2025, cash and equivalents stood at $83.2M ($114M pro forma including the ATM raise). Management explicitly stated that this balance would cover “at least one year” of obligations — which in biotech code means enough to survive the trial, but not enough to commercialize a product or fund additional pivotal programs without further dilution.

Runway is advertised as “one year past readout.” In biotech-speak, that means: we have enough cash to survive the trial, not enough to commercialize or launch another pivotal program without fresh money.

The Signal

When a company both:

Raises cash via an ATM into strength before the readout, and

Files a shelf registration weeks before topline…

…it’s not confidence. It’s hedging. Management is telegraphing they’ll need fresh capital in either scenario.

Investor Impact

Upside scenario: If efzofitimod hits, shareholders won’t celebrate long. A follow-on raise or ATM drip will cap the stock’s upside.

Downside scenario: If the trial misses, aTyr will still issue equity — just at depressed prices — to fund “next steps.”

Either way, dilution is not a risk — it’s a certainty.

Our Call

aTyr has already shown its hand. The science may be uncertain, but the financial engineering is crystal clear. This is a sell-the-news setup.

Shelf active.

ATM primed.

Cash runway short.

Shareholders last in line.

Blunt conclusion: In biotech, you follow the money to see management’s true expectations. At aTyr, the message is obvious: win or lose, common shareholders pay the bill.

Board & Governance: Credible Faces, Zero Products

The Cast of Characters

Paul Schimmel, PhD – Scientific founder. A giant in biochemistry and a serial biotech entrepreneur. His name lends credibility, but science alone doesn’t equal commercial success.

Sanjay Shukla, MD, MS – CEO since 2017. Originally brought in as Chief Medical Officer, promoted to lead after prior leadership exits. Shukla is a physician with industry experience (ex-Novartis). Under his tenure, the company narrowed all bets onto efzofitimod.

Eric Benevich, MBA – Chief Commercial Officer at Neurocrine, a well-regarded neuro biotech. He brings commercialization optics, but in a company with no product to commercialize, his role is window dressing.

Jane Gross, PhD – Former Amgen immunology executive, long track record in R&D. Brings drug development expertise, but no track record of turning aTyr’s programs into reality.

Svetlana Lucas, PhD – Deal-making background; currently CBO at Scribe Therapeutics. Experience in partnerships and business development, useful if the goal is to sell or license efzofitimod.

John K. Clarke – Venture capitalist (Cardinal Partners), early backer of Alnylam and Momenta. Chaired the board for nearly two decades before retiring in 2024.

The Track Record

20 years, zero approvals.

Despite credible names, the board has presided over a company that has consumed hundreds of millions in capital and produced no marketed drug.Pivots over progress.

They have overseen the quiet burial of Resolaris, the collapse of the ORCA immuno-oncology program, and the layoffs that followed. Their answer has always been the same: pivot to the next narrative.Reputational capital spent.

Having Schimmel or Gross on your board signals scientific heft. But credibility is a wasting asset. After two decades without success, those names now raise an uncomfortable question: why hasn’t this team delivered?

The Governance Reality

There’s no fraud here, no SEC probe, no lawsuit hanging over the boardroom. That’s not the issue. The issue is simpler, and arguably more damning: a respected team that’s had every chance to prove the platform and has nothing to show for it.

Boards are supposed to protect shareholder value. Instead, this one has presided over endless dilution and a company that’s perpetually “one trial away” from relevance.

Blunt conclusion:

aTyr’s governance is heavy on biotech résumés and light on results. This isn’t about bad actors — it’s about a company that’s become a graveyard for credibility.

Valuation & Peer Comparisons: Priced Like a Winner, Built Like a Loser

The Numbers Today

Market Cap: ~$500–550M (at $5–6/share, summer 2025).

Cash & Investments: ~$114M pro forma after the $30.7M ATM raise.

Burn Rate: ~$20M per quarter (R&D + G&A).

Enterprise Value (EV): ~$400M+ tied almost entirely to efzofitimod.

There is no diversified pipeline, no royalty stream, no commercial product. Investors are paying $400M for a single trial outcome.

Peer Benchmarks

Winners in Orphan ILD:

Boehringer Ingelheim’s nintedanib (Ofev) and Roche’s pirfenidone (Esbriet) are multibillion-dollar drugs. But they earned it: clean, statistically significant Phase 3 wins on hard lung function endpoints (FVC decline) in idiopathic pulmonary fibrosis (IPF).

Those wins were replicated, regulator-validated, and backed by Big Pharma scale.

Emerging Biotechs with Positive Pivotal Data:

Small orphan drug developers with clear pivotal success often get taken out in the $1–3B range. But they had de-risked datasets.

The Graveyard of Misses:

Failed ILD biotechs typically collapse to cash value or lower. Examples: Galecto, FibroGen (post-failure), and dozens of Phase 2/3 flameouts. These traded down 70–90% overnight when pivotal trials missed.

aTyr’s cash-adjusted floor is $2/share or less, implying $100M or below if efzofitimod fails.

The Disconnect

ATYR’s current valuation prices in >50% probability of success.

That’s aggressive, given:

Weak Phase 2 data (missed efficacy endpoints, only PRO wins at top dose).

A noisy Phase 3 endpoint (steroid taper).

History of failed programs and dilution cycles.

Blunt read: The stock is priced like a potential winner, but structurally looks like a loser waiting to be repriced to cash.

Investor Reality

If efzofitimod fails or is inconclusive, the $400M+ in enterprise value evaporates.

If efzofitimod succeeds, investors still face dilution — the shelf is active, the ATM is warm, and management will sell into strength.

Conclusion: aTyr is trading as if victory is more likely than not. History, data, and trial design say otherwise. The valuation gap is a spring-loaded trap — and when it snaps, common shareholders will take the hit.

Risk Scenarios & Probability Tree

Base Case: Trial Miss (50–60% Probability)

Scenario: EFZO-FIT fails to show a statistically significant primary endpoint win on steroid taper. Secondary endpoints (PROs, FVC) show noise or modest, non-convincing deltas.

Stock Reaction: Sharp sell-off. Shares retrace to cash-adjusted value (~$1.50–2.00/share).

Market Cap: ~$100–120M (near pro forma cash).

Investor Impact: 70–80% drawdown from current ~$5–6 levels.

Why it’s likely:

Phase 2 missed its efficacy primary.

Steroid taper endpoint is noisy, placebo improves naturally.

A modest effect size gets buried in variability.

Bear Case: Clear Failure (15–20% Probability)

Scenario: Trial shows no benefit, or worse, imbalance in safety events. Potential for early stop or futility call.

Stock Reaction: Collapse >80%. Trades below cash as investors price in restructuring risk.

Market Cap: Sub-$100M.

Investor Impact: Shareholders face both heavy losses and the prospect of near-term dilution just to keep lights on.

Why it matters: This is the biotech nightmare — no drug, no plan, just survival mode.

Bull Case: Stat-Sig Primary Win (20–25% Probability)

Scenario: Efzofitimod delivers a clean, statistically significant steroid-sparing win, with supportive PROs and lung function trends.

Stock Reaction: Pop of 150–250%, shares re-rate toward ~$15–20.

BUT: Management has already filed the shelf. Expect an ATM drip or follow-on raise within days.

Investor Impact: Gains capped. Dilution ensures upside is shared with management’s need for cash.

Why it’s capped: Success is a ticket to dilution, not free upside.

Tail Case: Home Run (5% Probability)

Scenario: Phase 3 delivers a clean win, regulators endorse the data, and a pharma partner or acquirer steps in.

Stock Reaction: Re-rate to $1–2B valuation (~$30–40/share).

Investor Impact: The moonshot outcome retail dreams of — but highly unlikely.

Why it’s improbable: Efzofitimod’s data package is thin, dependent on PROs, and hasn’t proven a clinically transformative effect.

The Math: Loaded Against Shareholders

Weighted Probability Outcome (blunt view):

Base Case (55%): $2/share

Bear Case (15%): $1/share

Bull Case (25%): $15/share

Tail Case (5%): $30/share

Expected Value: ~$5.25/share before dilution risk.

Realistic Adjusted Value: Lower, because management will dilute immediately on any win.

Blunt Conclusion: Investors are sitting on a powder keg where three out of four scenarios lead to heavy losses or capped upside. The risk/reward is not just asymmetrical — it’s stacked against the common shareholder.

Conclusion: A Familiar Biotech Ending

aTyr Pharma’s story isn’t unique — it’s a play we’ve seen dozens of times on Wall Street. A company sells investors on the promise of a grand platform, burns capital chasing dead ends, and finally stakes survival on a single drug with shaky evidence.

The history: Resolaris failed quietly. ORCA immuno-oncology collapsed with layoffs. Nearly 20 years later, the “platform” has no products.

The science: Efzofitimod’s biology is plausible, but its proof is thin. Phase 2 showed signals, not proof. Phase 3’s steroid taper endpoint is inherently noisy, a design where placebo often improves. Small effect sizes disappear in the noise.

The money: Management raised $30M ahead of data and filed a fresh S-3 shelf weeks before topline. That’s not confidence, that’s hedging. Win or lose, shareholders are staring at dilution.

The valuation: At ~$500M market cap, the company trades as if success is more likely than not. That’s a fantasy. Failed orphan ILD biotechs trade down to cash. At $2/share or less, that’s 60–80% downside from here.

The Blunt Reality

Investors aren’t buying a pipeline. They aren’t buying a platform. They’re buying the outcome of one noisy trial. If efzofitimod fails, the stock collapses. If it succeeds, the company dilutes. Either way, common shareholders lose.

This isn’t innovation. It’s financial engineering wrapped in scientific optimism. And with topline data due mid-September, the trapdoor is about to open.

BMF Call:

aTyr Pharma is a sell-the-news setup dressed up as a breakthrough story. We expect a 60–80% collapse in the coming weeks as hype meets reality, and the last chapter in this 20-year biotech saga closes the same way the others did: with investors left holding the bag.

Disclaimer

We are short sellers and have a financial Interest in the companies decline, we have opened a short postion at $5.76. This report is for informational purposes only. It is not financial advice, not a recommendation to buy or sell securities, and is based entirely on publicly available information. We are not your financial advisor, your fund manager, or your therapist.

If you’re one of those investors who bought into aTyr Pharma on hope and vibes, and you’re reading this foaming at the mouth — save it. We’d worry less about us writing a report and more about your biotech lottery ticket taking a dip straight out of your pocket.

Markets don’t care about your feelings. Neither do catalysts. And neither do we.

We dig, we publish, we stand by our work. If you don’t like it, do what the rest of Wall Street does: prove us wrong with data, not with comments written in all caps.

A Platform in Search of an Indication

When aTyr Pharma (NASDAQ: ATYR) went public, it sold investors on a dream: a breakthrough “platform” based on the mysterious biology of tRNA synthetases. The pitch was that this unique corner of cell machinery could be tapped to generate a pipeline of first-in-class drugs across multiple diseases.

Fast-forward almost twenty years. The platform is still a platform in name only. The muscular dystrophy program? Shelved. The immuno-oncology effort? Dead after weak preclinical data and a round of layoffs. The “pipeline” has shrunk down to a single lifeline: efzofitimod, a biologic pitched as a solution for pulmonary sarcoidosis.

That’s the uncomfortable truth: ATYR is no longer a platform company. It is a one-drug company. If efzofitimod fails, there’s nothing left. If it wins, the company will immediately turn to Wall Street to monetize the victory through dilution.

And this is where investors need to focus.

The data aren’t decisive. Phase 2 showed modest improvements at best — statistically significant only in post-hoc PROs at the highest dose. Lung function results weren’t significant.

The Phase 3 design is stacked with noise. The endpoint is steroid reduction after a year of forced tapering — a measure known to fluctuate in sarcoidosis even under placebo.

Management already filed its escape hatch. In August 2025, weeks before topline results, aTyr filed a fresh Form S-3 shelf registration, effective Aug 18. The ATM window is open, and dilution is coming.

This isn’t just another risky biotech. It’s a textbook example of how small-cap biotechs game the system: sell the platform story, pivot after failures, and keep Wall Street on the hook until the very last card is played.

If you own ATYR, you own the outcome of a single trial — EFZO-FIT — with a steroid-sparing endpoint that is extremely difficult to win unless the drug’s effect size is robust and undeniable.

Platform Autopsy: Two Decades, Zero Deliverables

aTyr Pharma didn’t start as a sarcoidosis company. It started as a tRNA synthetase “platform” play — a story pitched to investors as a discovery engine with limitless applications. The reality is less glamorous: twenty years in, the “platform” has yet to yield a single commercial product. What it has produced instead are quiet failures, abrupt layoffs, and desperate pivots.

Resolaris (ATYR1940): The Muscle Drug That Never Flexed

Launched: Mid-2010s as the company’s flagship in rare muscular dystrophies (FSHD, LGMD).

The pitch: Modulate immune pathways, reduce muscle inflammation, slow progression.

The outcome: Early trials showed “promising signals” but failed to generate durable, convincing efficacy. Patients didn’t meaningfully improve, regulators weren’t impressed, and enthusiasm faded.

Status: Quietly shelved by 2017–2018. No big press release announcing failure, just a slow disappearance from investor decks.

Figure: aTyr’s Early “Encouraging Signals” for Resolaris (2016)

In March 2016, aTyr Pharma issued a press release touting “potential activity signals” from a small Phase 1b/2 trial of Resolaris in rare muscle diseases. Despite the optimistic tone — highlighting safety, tolerability, and the potential for expansion into multiple indications — the program never delivered durable efficacy. By 2017–2018, Resolaris was quietly shelved, disappearing from investor decks without a formal announcement. This marked the first of aTyr’s flagship failures, foreshadowing its pattern of hype, pivot, and silence. READ HERE

Takeaway: The first big promise out of the tRNA platform evaporated without delivering a viable path forward.

ORCA: The Immuno-Oncology Bet That Imploded

Launched: 2017 as an ambitious pivot into cancer immunotherapy.

The pitch: Apply the same extracellular tRNA biology to “resokines” and immune modulation in oncology.

The outcome: By early 2018, preclinical data failed to show compelling activity. The program was stopped cold.

Fallout: aTyr announced 30% layoffs in May 2018, blaming the poor ORCA data and acknowledging resources had to be retrenched around their last surviving hope, efzofitimod.

Status: Abandoned. Another “transformational” pillar reduced to dust.

Figure: ORCA Implodes, Layoffs Follow (2018)

In May 2018, aTyr Pharma announced it was cutting 30% of its workforce after its ORCA immuno-oncology program collapsed in preclinical testing. The company admitted its anticancer antibodies “lacked the required efficacy,” forcing it to halt IND-enabling activities. ORCA had been pitched as the company’s next transformational pillar, leveraging the “resokine pathway” to enhance checkpoint inhibitors. Within a year, the program was gone, and efzofitimod became the company’s last remaining shot. READ HERE

Takeaway: The second major platform bet collapsed before ever reaching the clinic, leaving the company gutted and on life support.

The Pattern: Pivots, Not Progress

2005–2015: Platform hype.

2015–2017: Resolaris hype cycle → shelved.

2017–2018: ORCA hype cycle → terminated, layoffs.

2018–Present: Efzofitimod hype cycle → now the only card left in the deck.

This isn’t the track record of a thriving platform company. It’s the track record of a biotech burning through narratives until only one story remains.

Blunt Conclusion: aTyr’s history doesn’t convict efzofitimod by itself, but it sets a precedent investors can’t ignore: every prior “breakthrough” ended in silence. The burden of proof for this Phase 3 is sky-high.

The Drug, The Data, The Odds

3.1 Mechanism & Preclinical: Biology vs. Reality

Target: Efzofitimod (ATYR1923) binds Neuropilin-2 (NRP2), a receptor expressed on T-cells, macrophages, and granulomas — the immune clumps that define sarcoidosis.

Claim: By modulating NRP2 signaling, efzofitimod dampens inflammation without broad immunosuppression, offering a “precision steroid alternative.”

Evidence: In animal and in-vitro models, efzofitimod reduced certain inflammatory markers and cytokines.

But:

Preclinical models did not demonstrate a significant reduction in granulomas, the hallmark lesion of sarcoidosis.

These were reductionist systems (P. acnes mouse; in-vitro granuloma cultures) — useful for plausibility, but historically unreliable for predicting human outcomes.

Figure: Preclinical Disconnect in Sarcoidosis Model

In the P. acnes-induced sarcoidosis mouse model (bottom row), efzofitimod reduced certain biomarkers (IFN-γ, IL-6, MCP-1) but showed no significant impact on granulomatous inflammation (far right panel). This gap highlights the translational weakness: efzofitimod may modulate inflammatory signals, but it fails to reduce the hallmark lesion of sarcoidosis — granulomas.

Blunt read: There’s enough biology here to justify running a trial. But there’s not enough to call efzofitimod a validated drug candidate.

3.2 Phase 1b/2a (Chest, 2023): What Really Happened

Design:

37 patients with pulmonary sarcoidosis.

Placebo vs. efzofitimod (1, 3, 5 mg/kg).

Primary endpoint: Safety, not efficacy.

All patients underwent a forced steroid taper toward ≤5 mg/day.

Results:

Safety: Clean — no dose-limiting toxicities.

Steroid reduction:

~22% baseline-adjusted relative reduction vs. placebo at 5 mg/kg.

Absolute difference modest; variability high.

Patient-reported outcomes (PROs):

Several statistically significant wins in fatigue and lung symptom domains — but only in the highest dose group.

Lung function (FVC % predicted):

Trend in right direction at higher doses.

Not statistically significant.

Follow-up analyses:

Exposure–response modeling (Frontiers Pharmacol, 2023): Suggested patients with higher efzofitimod exposure had greater steroid reduction and FVC improvement. But this was post-hoc modeling, not pre-specified.

ERS Open Research (2025): Confirmed dose-response signal and PRO significance at higher doses. Still no slam dunk on hard lung function endpoints.

Figure: Phase 2 Trial Outcomes for Efzofitimod (Trial.MedPath, 2025)

Steroid-sparing: 22% relative reduction at 5 mg/kg; smaller reductions at 3 mg/kg (9%) and 1 mg/kg (5%).

Safety: Clean, with no serious drug-related adverse events.

Patient-reported outcomes (PROs): Significant wins at the highest dose (5 mg/kg) across fatigue, lung scores (SAT, KSQ), and quality-of-life domains.

Interpretation: Even in polished media coverage, the picture is clear — activity, not proof. Efficacy relied on PROs and steroid tapering at the highest dose, while lung function (FVC) failed to reach statistical significance. READ HERE

Blunt read: The Phase 2 data showed activity, not proof. Stat-sig patient questionnaires are nice, but regulators and investors don’t approve drugs on surveys alone. Lung function and steroid endpoints didn’t clear the bar.

3.3 Phase 3 EFZO-FIT: A High-Wire Act

Design:

268 patients, global, 52 weeks.

Efzofitimod 3 mg/kg and 5 mg/kg vs placebo.

Primary endpoint: Change in steroid dose at Week 48 under a forced taper.

Secondaries: Patient-reported outcomes, lung function, symptoms.

Risks in design:

Spontaneous improvement: Sarcoidosis often improves over 12 months even without drug — placebo patients naturally taper steroids.

Taper variability: Different patients tolerate steroid reductions differently, creating noise.

Small true effect size: If efzofitimod’s benefit is modest, it risks being buried under placebo-driven taper success.

Figure: EFZO-FIT Phase 3 Trial Design (Company Materials)

The EFZO-FIT trial enrolled 268 patients with pulmonary sarcoidosis across the U.S., Europe, Japan, and Brazil. It is a 52-week, double-blind, placebo-controlled study testing 3.0 mg/kg and 5.0 mg/kg of efzofitimod vs. placebo, dosed monthly for 12 months. The design incorporates a forced steroid taper, with the primary endpoint set as steroid reduction. Secondary endpoints include sarcoidosis symptoms and lung function.

Interpretation: The company’s own description confirms the inherent trial risk: forced steroid taper as a primary endpoint is notoriously noisy, especially in a disease like sarcoidosis that can improve spontaneously. Unless efzofitimod shows a large, undeniable effect, small deltas risk being buried in placebo-driven improvement. READ HERE

Blunt read: Unless efzofitimod delivers a large, clear effect, this trial is set up to produce ambiguous or negative results. Small deltas will not survive statistical rigor.

3.4 Our View

Preclinical: Mechanism plausible, but weak translational foundation.

Phase 2: Showed signals of activity, but failed its primary efficacy test.

Phase 3: A risky design in a noisy disease — low-to-moderate probability of a decisive win.

Bottom line: Efzofitimod has biology. It has signals. What it doesn’t have is proof. And Wall Street is pricing it as if proof is a given.

Mechanistic Red Flags: The Biology Doesn’t Hold Up

Binding to NRP2 is Unproven

aTyr’s entire pitch hangs on efzofitimod binding to Neuropilin-2 (NRP2) as its precision mechanism. But there’s a glaring hole: there are no published affinity values (Kd) showing how tightly efzofitimod actually binds. In drug development, binding affinity is table stakes — it tells you if the molecule has a strong and specific interaction with its target. Without it, the “precision” claim is smoke.

The assays they’ve shared lean on avidity-driven events — basically multivalent interactions that look like binding, but aren’t the same as high-affinity lock-and-key proof. This is biotech 101: if you can’t show affinity, you don’t have a target.

No Downstream Signaling Shown

Even if efzofitimod touches NRP2, the real question is: does it do anything useful once it’s there? aTyr hasn’t shown it. There’s no evidence of downstream signaling — no phosphorylation events, no p-AKT activation, no angiogenesis signal.

Instead, they offer a dimerization assay: showing NRP2 cozying up to Plexin or FLT4. That’s proximity, not proof. Without a signaling cascade, the mechanism is a car with no engine. It looks like a vehicle, but it isn’t going anywhere.

Speculative Alternate Mechanisms

Independent analysts have speculated efzofitimod could be triggering CCR5 chemotaxis, potentially leading to lymphangiogenesis and an immunosuppressive phenotype in vivo. But this is pure conjecture. There are no wet-lab experiments validating this alternate pathway.

In other words, we’ve left the realm of evidence and entered the realm of fan fiction. A “maybe it does this” explanation is not how you de-risk a $500M biotech.

NRP2 is a Graveyard Pathway

aTyr isn’t the first to chase NRP2 as a therapeutic lever. Others have tried — and failed. The pathway has proven intractable in multiple settings. Sarcoid experts themselves are skeptical that NRP2 can serve as a “master switch” to resolve granulomatous inflammation. If history is any guide, this isn’t a revolutionary precision target — it’s a cul-de-sac where programs go to die.

Poor Preclinical Translation

Ask any sarcoid researcher which preclinical model best mirrors the disease, and most will point to the P. acnes mouse model. Even there, efzofitimod showed no meaningful reduction in granuloma burden. Yes, it shifted some inflammatory markers, but the core pathology — the mud balls that choke off lungs — didn’t budge.

That’s a death knell for translation. If your drug doesn’t clear lesions in the model most respected by the field, it’s fantasy to expect a slam dunk in humans.

Why This Matters: This isn’t nitpicking. Drug development lives and dies on mechanism. Efzofitimod’s mechanistic case is riddled with gaps: no binding data, no signaling proof, speculative alternate MoAs, a target pathway littered with prior failures, and preclinical models that don’t translate.

Blunt Read: Efzofitimod has biology, but not proof. It’s a story stitched together with hand-waving and wishful thinking. When independent analysts outside BMF flag the same blind spots, the conclusion is unavoidable: Phase 3 is less a test of science than a test of investor gullibility.

Follow the Money: The Shelf, the ATM, and the Inevitable Dilution

The Playbook

In small-cap biotech, the science is only half the story. The other half is how management funds survival. aTyr is following the script to the letter: raise opportunistically, file a shelf before a catalyst, and prepare to dilute regardless of outcome.

The Shelf

Filed: August 7, 2025.

Declared Effective: August 18, 2025.

Form: S-3 shelf registration.

What does this mean? With the stroke of a pen, management gave itself the ability to issue new securities at will — stock, warrants, debt — without waiting months for SEC review. Filing just weeks before a binary catalyst is no coincidence. It’s insurance.

If data are positive: They can sell into the pop immediately, capturing inflated valuations before reality sets in.

If data are negative: They can still raise survival capital without delay.

Figure: $300 Million Shelf Registration (Filed August 7, 2025)

In August 2025, just weeks before the pivotal EFZO-FIT readout, aTyr Pharma filed an S-3 shelf registration authorizing the sale of up to $300 million in securities — including common stock, preferred stock, debt, and warrants. This filing, effective August 18, gave management the ability to issue shares instantly without waiting for SEC clearance. The timing is no accident: it’s pre-catalyst insurance, ensuring dilution whether data are good or bad. READ HERE

Blunt translation: Filing the shelf before the readout is management saying out loud: “We’re going to dilute you, one way or another.”

The ATM

Q2 2025 raise: aTyr tapped its at-the-market (ATM) facility, raising ~$30.7M through Jefferies.

Cash position: $83.2M on June 30, 2025 → $114M pro forma after the raise.

Burn rate: ~$20M/quarter (R&D + G&A).

Figure: ATM Dilution and Cash Runway (Q2 2025 10-Q)

From aTyr’s Q2 2025 10-Q: the company disclosed raising $36.7M via its at-the-market (ATM) program with Jefferies, selling 8.77 million shares at a weighted average price of $4.32. As of June 30, 2025, cash and equivalents stood at $83.2M ($114M pro forma including the ATM raise). Management explicitly stated that this balance would cover “at least one year” of obligations — which in biotech code means enough to survive the trial, but not enough to commercialize a product or fund additional pivotal programs without further dilution.

Runway is advertised as “one year past readout.” In biotech-speak, that means: we have enough cash to survive the trial, not enough to commercialize or launch another pivotal program without fresh money.

The Signal

When a company both:

Raises cash via an ATM into strength before the readout, and

Files a shelf registration weeks before topline…

…it’s not confidence. It’s hedging. Management is telegraphing they’ll need fresh capital in either scenario.

Investor Impact

Upside scenario: If efzofitimod hits, shareholders won’t celebrate long. A follow-on raise or ATM drip will cap the stock’s upside.

Downside scenario: If the trial misses, aTyr will still issue equity — just at depressed prices — to fund “next steps.”

Either way, dilution is not a risk — it’s a certainty.

Our Call

aTyr has already shown its hand. The science may be uncertain, but the financial engineering is crystal clear. This is a sell-the-news setup.

Shelf active.

ATM primed.

Cash runway short.

Shareholders last in line.

Blunt conclusion: In biotech, you follow the money to see management’s true expectations. At aTyr, the message is obvious: win or lose, common shareholders pay the bill.

Board & Governance: Credible Faces, Zero Products

The Cast of Characters

Paul Schimmel, PhD – Scientific founder. A giant in biochemistry and a serial biotech entrepreneur. His name lends credibility, but science alone doesn’t equal commercial success.

Sanjay Shukla, MD, MS – CEO since 2017. Originally brought in as Chief Medical Officer, promoted to lead after prior leadership exits. Shukla is a physician with industry experience (ex-Novartis). Under his tenure, the company narrowed all bets onto efzofitimod.

Eric Benevich, MBA – Chief Commercial Officer at Neurocrine, a well-regarded neuro biotech. He brings commercialization optics, but in a company with no product to commercialize, his role is window dressing.

Jane Gross, PhD – Former Amgen immunology executive, long track record in R&D. Brings drug development expertise, but no track record of turning aTyr’s programs into reality.

Svetlana Lucas, PhD – Deal-making background; currently CBO at Scribe Therapeutics. Experience in partnerships and business development, useful if the goal is to sell or license efzofitimod.

John K. Clarke – Venture capitalist (Cardinal Partners), early backer of Alnylam and Momenta. Chaired the board for nearly two decades before retiring in 2024.

The Track Record

20 years, zero approvals.

Despite credible names, the board has presided over a company that has consumed hundreds of millions in capital and produced no marketed drug.Pivots over progress.

They have overseen the quiet burial of Resolaris, the collapse of the ORCA immuno-oncology program, and the layoffs that followed. Their answer has always been the same: pivot to the next narrative.Reputational capital spent.

Having Schimmel or Gross on your board signals scientific heft. But credibility is a wasting asset. After two decades without success, those names now raise an uncomfortable question: why hasn’t this team delivered?

The Governance Reality

There’s no fraud here, no SEC probe, no lawsuit hanging over the boardroom. That’s not the issue. The issue is simpler, and arguably more damning: a respected team that’s had every chance to prove the platform and has nothing to show for it.

Boards are supposed to protect shareholder value. Instead, this one has presided over endless dilution and a company that’s perpetually “one trial away” from relevance.

Blunt conclusion:

aTyr’s governance is heavy on biotech résumés and light on results. This isn’t about bad actors — it’s about a company that’s become a graveyard for credibility.

Valuation & Peer Comparisons: Priced Like a Winner, Built Like a Loser

The Numbers Today

Market Cap: ~$500–550M (at $5–6/share, summer 2025).

Cash & Investments: ~$114M pro forma after the $30.7M ATM raise.

Burn Rate: ~$20M per quarter (R&D + G&A).

Enterprise Value (EV): ~$400M+ tied almost entirely to efzofitimod.

There is no diversified pipeline, no royalty stream, no commercial product. Investors are paying $400M for a single trial outcome.

Peer Benchmarks

Winners in Orphan ILD:

Boehringer Ingelheim’s nintedanib (Ofev) and Roche’s pirfenidone (Esbriet) are multibillion-dollar drugs. But they earned it: clean, statistically significant Phase 3 wins on hard lung function endpoints (FVC decline) in idiopathic pulmonary fibrosis (IPF).

Those wins were replicated, regulator-validated, and backed by Big Pharma scale.

Emerging Biotechs with Positive Pivotal Data:

Small orphan drug developers with clear pivotal success often get taken out in the $1–3B range. But they had de-risked datasets.

The Graveyard of Misses:

Failed ILD biotechs typically collapse to cash value or lower. Examples: Galecto, FibroGen (post-failure), and dozens of Phase 2/3 flameouts. These traded down 70–90% overnight when pivotal trials missed.

aTyr’s cash-adjusted floor is $2/share or less, implying $100M or below if efzofitimod fails.

The Disconnect

ATYR’s current valuation prices in >50% probability of success.

That’s aggressive, given:

Weak Phase 2 data (missed efficacy endpoints, only PRO wins at top dose).

A noisy Phase 3 endpoint (steroid taper).

History of failed programs and dilution cycles.

Blunt read: The stock is priced like a potential winner, but structurally looks like a loser waiting to be repriced to cash.

Investor Reality

If efzofitimod fails or is inconclusive, the $400M+ in enterprise value evaporates.

If efzofitimod succeeds, investors still face dilution — the shelf is active, the ATM is warm, and management will sell into strength.

Conclusion: aTyr is trading as if victory is more likely than not. History, data, and trial design say otherwise. The valuation gap is a spring-loaded trap — and when it snaps, common shareholders will take the hit.

Risk Scenarios & Probability Tree

Base Case: Trial Miss (50–60% Probability)

Scenario: EFZO-FIT fails to show a statistically significant primary endpoint win on steroid taper. Secondary endpoints (PROs, FVC) show noise or modest, non-convincing deltas.

Stock Reaction: Sharp sell-off. Shares retrace to cash-adjusted value (~$1.50–2.00/share).

Market Cap: ~$100–120M (near pro forma cash).

Investor Impact: 70–80% drawdown from current ~$5–6 levels.

Why it’s likely:

Phase 2 missed its efficacy primary.

Steroid taper endpoint is noisy, placebo improves naturally.

A modest effect size gets buried in variability.

Bear Case: Clear Failure (15–20% Probability)

Scenario: Trial shows no benefit, or worse, imbalance in safety events. Potential for early stop or futility call.

Stock Reaction: Collapse >80%. Trades below cash as investors price in restructuring risk.

Market Cap: Sub-$100M.

Investor Impact: Shareholders face both heavy losses and the prospect of near-term dilution just to keep lights on.

Why it matters: This is the biotech nightmare — no drug, no plan, just survival mode.

Bull Case: Stat-Sig Primary Win (20–25% Probability)

Scenario: Efzofitimod delivers a clean, statistically significant steroid-sparing win, with supportive PROs and lung function trends.

Stock Reaction: Pop of 150–250%, shares re-rate toward ~$15–20.

BUT: Management has already filed the shelf. Expect an ATM drip or follow-on raise within days.

Investor Impact: Gains capped. Dilution ensures upside is shared with management’s need for cash.

Why it’s capped: Success is a ticket to dilution, not free upside.

Tail Case: Home Run (5% Probability)

Scenario: Phase 3 delivers a clean win, regulators endorse the data, and a pharma partner or acquirer steps in.

Stock Reaction: Re-rate to $1–2B valuation (~$30–40/share).

Investor Impact: The moonshot outcome retail dreams of — but highly unlikely.

Why it’s improbable: Efzofitimod’s data package is thin, dependent on PROs, and hasn’t proven a clinically transformative effect.

The Math: Loaded Against Shareholders

Weighted Probability Outcome (blunt view):

Base Case (55%): $2/share

Bear Case (15%): $1/share

Bull Case (25%): $15/share

Tail Case (5%): $30/share

Expected Value: ~$5.25/share before dilution risk.

Realistic Adjusted Value: Lower, because management will dilute immediately on any win.

Blunt Conclusion: Investors are sitting on a powder keg where three out of four scenarios lead to heavy losses or capped upside. The risk/reward is not just asymmetrical — it’s stacked against the common shareholder.

Conclusion: A Familiar Biotech Ending

aTyr Pharma’s story isn’t unique — it’s a play we’ve seen dozens of times on Wall Street. A company sells investors on the promise of a grand platform, burns capital chasing dead ends, and finally stakes survival on a single drug with shaky evidence.

The history: Resolaris failed quietly. ORCA immuno-oncology collapsed with layoffs. Nearly 20 years later, the “platform” has no products.

The science: Efzofitimod’s biology is plausible, but its proof is thin. Phase 2 showed signals, not proof. Phase 3’s steroid taper endpoint is inherently noisy, a design where placebo often improves. Small effect sizes disappear in the noise.

The money: Management raised $30M ahead of data and filed a fresh S-3 shelf weeks before topline. That’s not confidence, that’s hedging. Win or lose, shareholders are staring at dilution.

The valuation: At ~$500M market cap, the company trades as if success is more likely than not. That’s a fantasy. Failed orphan ILD biotechs trade down to cash. At $2/share or less, that’s 60–80% downside from here.

The Blunt Reality

Investors aren’t buying a pipeline. They aren’t buying a platform. They’re buying the outcome of one noisy trial. If efzofitimod fails, the stock collapses. If it succeeds, the company dilutes. Either way, common shareholders lose.

This isn’t innovation. It’s financial engineering wrapped in scientific optimism. And with topline data due mid-September, the trapdoor is about to open.

BMF Call:

aTyr Pharma is a sell-the-news setup dressed up as a breakthrough story. We expect a 60–80% collapse in the coming weeks as hype meets reality, and the last chapter in this 20-year biotech saga closes the same way the others did: with investors left holding the bag.

Disclaimer

We are short sellers and have a financial Interest in the companies decline, we have opened a short postion at $5.76. This report is for informational purposes only. It is not financial advice, not a recommendation to buy or sell securities, and is based entirely on publicly available information. We are not your financial advisor, your fund manager, or your therapist.

If you’re one of those investors who bought into aTyr Pharma on hope and vibes, and you’re reading this foaming at the mouth — save it. We’d worry less about us writing a report and more about your biotech lottery ticket taking a dip straight out of your pocket.

Markets don’t care about your feelings. Neither do catalysts. And neither do we.

We dig, we publish, we stand by our work. If you don’t like it, do what the rest of Wall Street does: prove us wrong with data, not with comments written in all caps.

Related